Trust administration is the process of identifying and collecting the trust’s assets, satisfying debts and tax obligations of the decedent, creating continuing trusts for the surviving spouse, descendants and other loved ones, distributing remaining assets to the appropriate remainder beneficiaries, and terminating the trust after all of the trust’s assets have been distributed.

With extensive experience in trust administration, tax compliance, accounting, and family governance, Jacqueline Yu helps trustees fulfill their fiduciary obligations under California law.

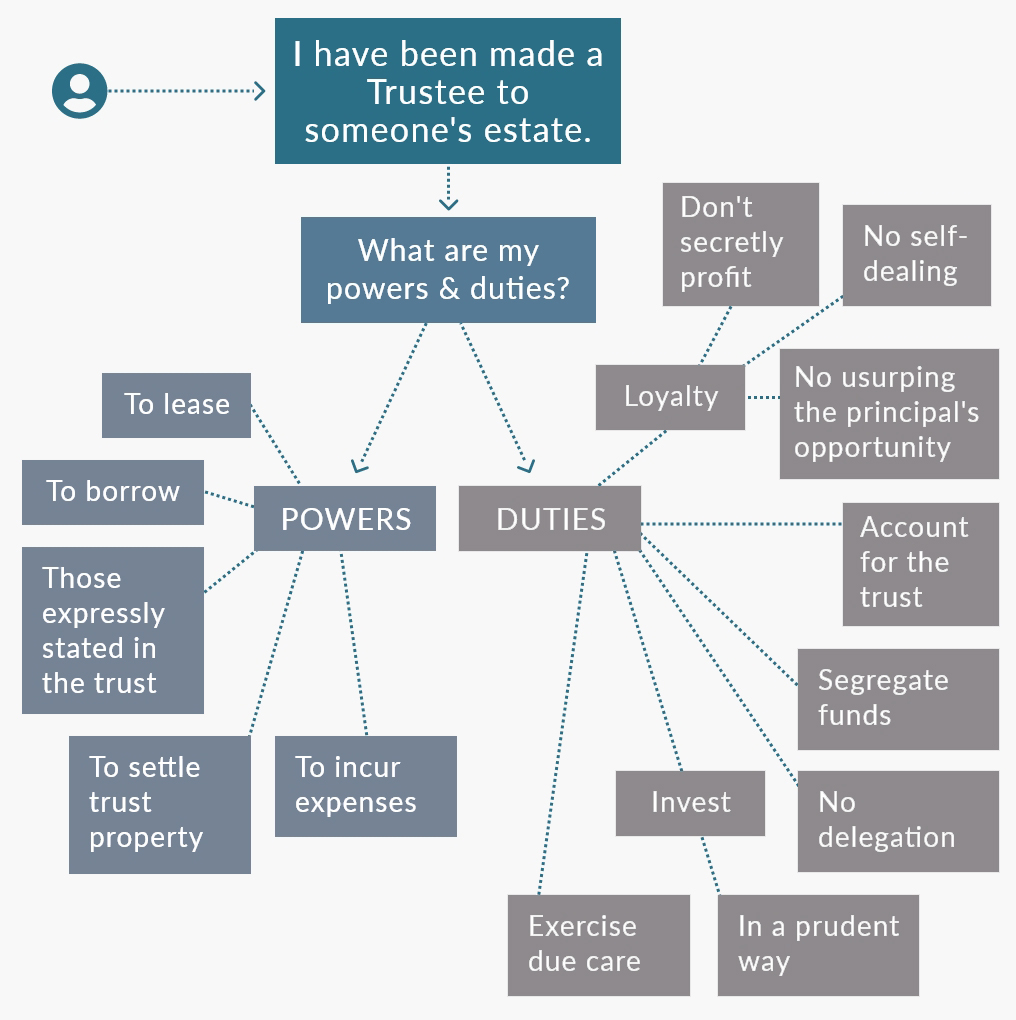

I have been made a Trustee to someone's estate.

What are my powers & duties?

- Powers

- To lease

- To borrow

- Those expressly stated in the trust

- To settle trust property

- To incur expenses

- Loyalty

- Don't secretly profit

- No self-dealing

- No ursurping the principal's opportunity

- Account for the trust

- Segregate funds

- No delegation

- Invest

- In a prudent way

- Exercise due care

Ms. Yu is focused on providing her clients with holistic, solution-focused legal services that effectively protect their rights and interests. Among other types of trust administration issues, she has experience assisting clients with:

- Advising on notifying beneficiaries and government agencies, tax reporting, trust accounting, asset allocation, the protection and distribution of assets, and the general duties of fiduciaries under California law.

- Analyzing the estate and income tax consequences related to asset allocation, trust funding and distributions.

- Modifying irrevocable trusts.

- Advising trustees on the administration of estates of foreign persons who owned assets situated in the United States.

- Finding out-of-court solutions to resolve disagreements among beneficiaries.

- Advising trustees on the administration of estates of foreign persons who owned assets situated in the United States.

- Analyzing the estate and income tax consequences related to asset allocation, trust funding and distributions.